Blacksmith Project

project overview

Red Hawk Mining is focussed on developing its 100% owned Blacksmith Iron Ore Project in the Pilbara region of Western Australia. The Pilbara hosts many world-class iron ore mines and is the world’s largest producing region of seaborne iron ore. With its close proximity to major iron ore markets, including China, Japan, South Korea and India, iron ore exports from the Pilbara exceeded 750 million tonnes in 2022.

The Blacksmith Project is located approximately 70km north-west of Tom Price and consists of mining lease M47/1451 (112km2). Blacksmith is nestled amongst many major iron ore projects, including Mt Tom Price, Brockman, Solomon and Eliwana. In addition to major iron ore deposits and projects, the region contains significant associated road, rail and power infrastructure.

Red Hawk is focused on ‘right sizing’ the Blacksmith Project to develop a lower tonnage, higher grade project which will provide sufficient direct shipping ore (DSO) for a robust mining operation. We are able to draw on the extensive work completed for previous alternatives of the Project including State and Federal approvals, Native Title agreements and over 200,000 metres of drilling.

highlights

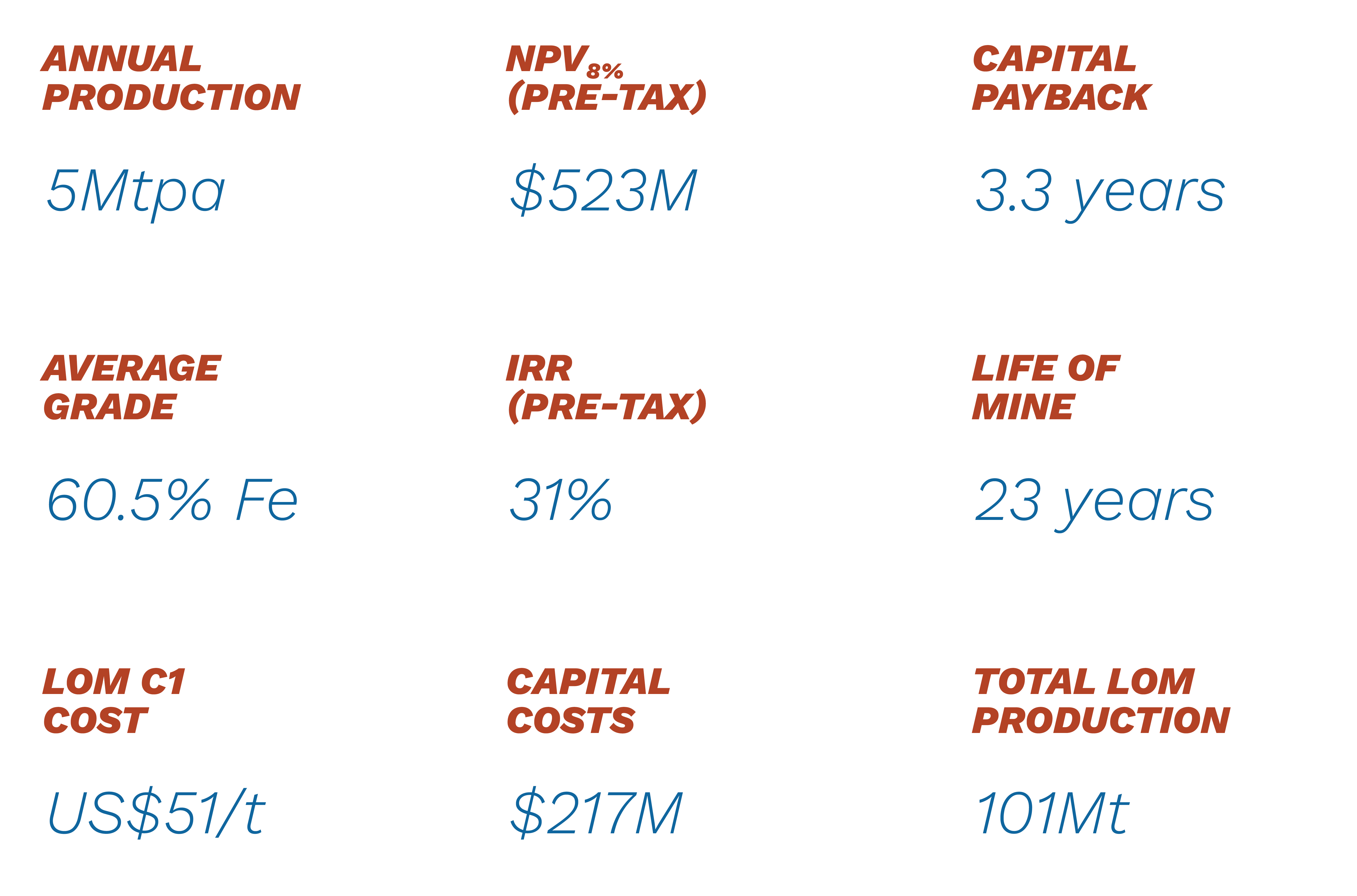

Recent Pre-Feasibility Study demonstrated the economic viability of developing a 5Mtpa direct shipping ore (DSO) project.

Over 200,000 metres of drilling has defined the largest DSO resource of any ASX-listed junior iron ore company (excluding magnetite) with 174Mt at 60.0% Fe

Focused on minimising capital expenditure with contract mining, crushing and trucking, and utilising public roads and third-party ports

Targeting first ore to market in 2025, subject to completion of economic studies, regulatory and third-party approvals, and financing

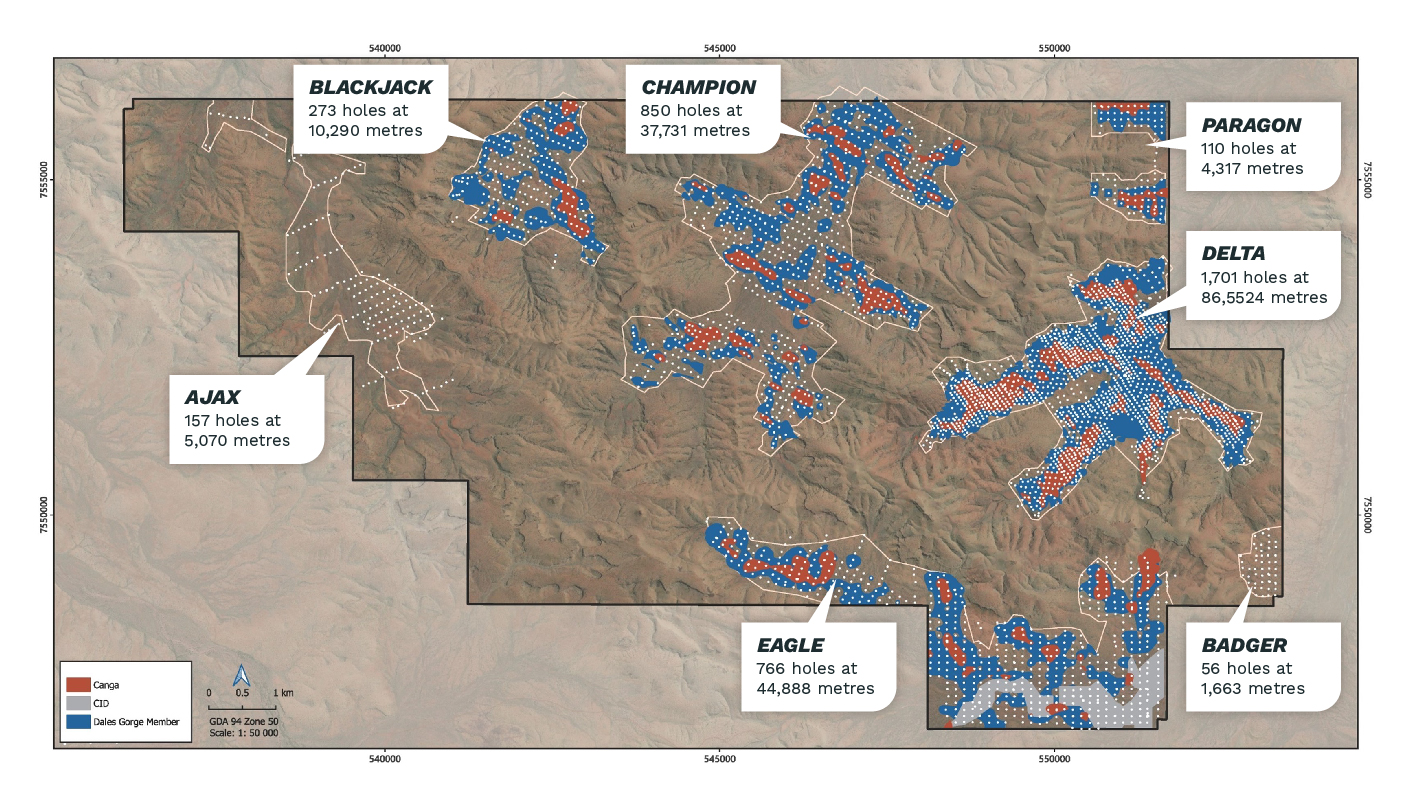

Significant exploration has been undertaken at Blacksmith since 2008 with over 200,000 metres of reverse circulation, diamond and sonic drilling completed. The drilling programs have defined iron ore resources in seven shallow deposits: Ajax, Badger, Blackjack, Champion, Delta, Eagle and Paragon.

The potentially economic mineralisation types at the Blacksmith Project comprise canga (hematite) and Dales Gorge Member hardcap (goethite), with minor contribution from detrital materials. The hematite-dominant canga ore generally has iron content above 60% Fe. The Dales Gorge Member underlies the canga and is predominantly goethite.

The Blacksmith Project is underpinned by a substantial deposit knowledge base, including over 200,000m of historical drilling, assays, geological modelling, metallurgical testwork and geophysical data. This knowledge base has been re-interpreted by CSA Global to improve the geological characterisation and lithological domaining of the deposits.

Blacksmith DSO Mineral Resource Estimate for re-interpreted orebodies – Blackjack, Champion, Delta, Eagle and Paragon1

| JORC Classification | Tonnage Mt | Fe % | P % | SiO2 % | AL2O3 % | LOI % |

|---|---|---|---|---|---|---|

| Measured | 66.6 | 60.2 | 0.094 | 4.64 | 3.05 | 5.44 |

| Indicated | 168.2 | 58.9 | 0.085 | 5.85 | 3.49 | 5.49 |

| Inferred | 8.6 | 59.8 | 0.104 | 4.09 | 2.35 | 7.24 |

| Total | 243.4 | 59.3 | 0.088 | 5.45 | 3.32 | 5.54 |

1 The Blacksmith Mineral Resources includes the Ajax, Badger, Blackjack, Champion, Delta, Eagle and Paragon deposits. All the estimates making up the Blacksmith Mineral Resource are reported to JORC 2012 standards.

Proposed Development

Red Hawk released a Mineral Resource Estimate (MRE) for the Delta and Paragon deposits in September 2023 which confirmed sufficient +60% Fe mineralisation with low deleterious elements to potentially build a robust mining operation. The Delta and Paragon deposits formed the basis of a Scoping Study which was released in October 2023 and confirmed the significant value in developing high quality direct shipping ore (DSO) resources.

In May 2024, Red Hawk released the positive outcomes of the Pre-Feasibility Study (PFS), which demonstrated with a high degree of certainty that the Project can deliver 5 million tonnes per annum of DSO product for over 20 years.

The PFS extended the Project’s scope to include the updated Mineral Resource Estimate for the Champion and Blackjack deposits, released in October 2023. The Study also included a maiden Ore Reserve for the Delta deposit which will provide over 86% of iron ore for the first 13 years of production, adding further geological and commercial certainty to the Project economics.

Key highlights of the PFS include:

Competent Person Statement

The information in the PFS report that relates to Mineral Resources for the Delta, Paragon, Champion and Blackjack deposits is based on, and fairly represents, information compiled by Mr Aaron Meakin and Mr Mark Pudovskis. Mr Aaron Meakin is a full-time employee of ERM Australia (formerly CSA Global) and is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy (AusIMM). Mr Mark Pudovskis is a full-time employee of ERM Australia (formerly CSA Global), and is a Member of the Australasian Institute of Mining and Metallurgy (AusIMM). Mr Aaron Meakin and Mr Mark Pudovskis have sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which they are undertaking to qualify as Competent Persons as defined in the JORC Code (2012). The Company confirms that the form and context in which the results are presented and all material assumptions and technical parameters underpinning the estimates in the original market announcement continue to apply and have not materially changed from the original announcements and that the form and context in which the Competent Persons’ findings are presented have not been materially modified from the original announcements on 6 September 2023 and 16 October 2023.

The information in the PFS report that relates to Ore Reserves for the Delta deposit is based on and fairly represents information compiled by Mr Ross Cheyne. Mr Ross Cheyne is a full-time employee and Head of Consulting with Orelogy and is a Fellow of the Australasian Institute of Mining and Metallurgy. Mr Ross Cheyne has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration, and to the activity he is undertaking, to qualify as a Competent Person as defined in the JORC Code (2012). Mr Ross Cheyne consents to the inclusion of the information in this report in the form and context in which it appears.

Photo Gallery